De Corporate Sustainability Reporting Directive (CSRD) van de Europese Unie en de bijbehorende European Sustainability Reporting Standards (ESRS) worden steeds belangrijker voor het stimuleren van transparantie en het afleggen van verantwoording. Bedrijven die onder het toepassingsgebied van de CSRD vallen, zijn verplicht om transparant te rapporteren over materiële onderwerpen. Hoewel het CSRD-framework 'belastingen' niet specifiek noemt, betekent dit niet dat belastingen irrelevant zijn als een onderwerp waarover entiteiten specifiek moeten rapporteren.

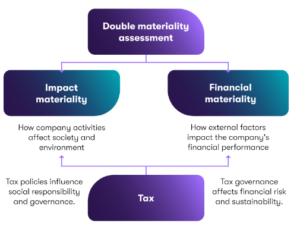

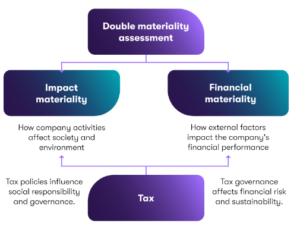

Companies subject to the CSRD and ESRS must conduct a so-called double materiality assessment to determine which topics they need to report on. This assessment includes evaluating both:

- Impact materiality: How do the company’s activities affect the broader environment, stakeholders and society, and how do they interact?

- Financial materiality: How do external factors impact the company’s financial performance (often in the form of ESG-related risks and opportunities)?

The question arises whether tax plays a role in the materiality assessment of relevant topics. In our experience, tax issues are increasingly recognized as relevant to both dimensions of the aforementioned materiality. More broadly speaking, a company’s approach to tax reflects a company’s social awareness, ethical governance and the associated risks. This topic is particularly significant with respect to increasing attention to ethical tax practices, strategic tax planning and corporate social responsibility (CSR).

The significance of tax disclosure and the GRI 207 framework

If tax is deemed material as part of the materiality assessment, companies are required to disclose tax-related information as part of their CSRD reporting. In the absence of specific standards by the ESRS for taxes, the standards of the Global Reporting Initiative (GRI) standards provide a useful framework. The GRI 207 Tax Standard offers a structured approach to disclose tax-related information, including tax strategy, governance, payments, and controversies. In practice this includes outlining the following topics:

- Approach to tax (GRI 207-1);

- Tax governance, control and risk management (GRI 207-2);

- Stakeholder engagement and management of concerns related to tax (GRI 207-3), and

- Country-by-country reporting (GRI 207-4).

Adopting the GRI 207 standards is also considered to meet the minimum safeguards of the EU Taxonomy (classification system for sustainable economic activities). This requires disclosure under Article 8 of Regulation 2020/852 (EU Taxonomy). This showcases companies adhering to developed tax governance practices, demonstrating compliance with relevant tax laws and regulations. It should be underlined that the CSRD also covers EU Taxonomy requirements.

Would tax transparency trigger voluntary disclosures?

The materiality assessment under CSRD may also result in the conclusion that tax may not be material in CSRD terms. This implies that the company is not obliged to include tax in its CSRD reporting. However, an increasing amount of organizations choose to disclose tax-related information voluntarily.

Such tax transparency helps to build trust with stakeholders by demonstrating their commitment to responsible and fair tax practices. Fair tax goes beyond just following tax laws. It's about being open about tax practices and treating taxes in a way to contribute to society. Companies that practice fair tax not only improve their reputation but also set good examples for their business partners, creating a positive impact across their entire network. Such disclosures can include detailed reporting on the company’s approach towards tax strategy, governance, and payments, aligning with the best practices and addressing stakeholders’ concerns about tax fairness and corporate integrity.

Concluding remarks

Tax is becoming increasingly relevant in CSRD and ESRS reporting. By conducting thorough materiality assessments, and following globally recognized standards like GRI, organizations can effectively communicate their tax strategies, governance practices, and compliance efforts. By addressing their tax affairs, companies not only meet regulatory expectations but also showcase a commitment to Sustainable Tax practices.

Bron: Grant Thornton,

https://www.grantthornton.nl/en/insights-en/tax/tax-a-crucial-element-in-csrd-reporting/